Valuation of a Business for Partner Buy-Out

When it comes to valuing a partner’s stake in the business, valuation of the business as a whole is the first step. The next big question is how to allocate this business value among the partners.

You may think that that the total business enterprise value should be divided in proportion to the partners ownership interests. Let’s say there are two partners, one owns 75% of the business and the other the remaining 25%. The overall business is worth $1,000,000. In the pro-rata allocation scenario, the first partner’s business ownership stake is worth $750,000 while the second partner has a claim on $250,000.

Control premia and minority ownership discounts

There are significant differences in the actual value of the two partnership interests though. The first partner, who owns the so-called controlling interest in the company, has a lot more say on how the critical decisions are made, including:

- Timing and size of dividend payouts or partnership draws.

- Hiring decisions.

- Acquisitions and sale of business assets.

- Raising equity and debt capital for business growth.

As a result, such controlling business ownership interest comes at a premium, quite often a significant one. You can watch the market for publicly traded company securities to see that. An acquiror making a bid for a controlling block of shares in a company tends to offer a price per share that exceeds the market price.

Translating the control premium to minority discount

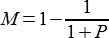

If you study the control premia offered, you can also deduce the minority discounts that apply to non-controlling business ownership interests. In fact, the minority discount can be calculated directly from the control premium as follows:

Here P stands for the control premium, expressed as a ratio, and M is the minority discount.

Example

Suppose that a group of investors wants to buy a 75% stake in a company. Current price per share of company stock is $10. The investors offer $15 per share. This means that the investors are ready to pay a 50% premium to get the controlling 75% ownership of the company.

Using the formula above, we can calculate how much minority discount applies to a non-controlling partner’s share who owns the remaining 25% of the business.

In this case M = 33.33%. In other words, each share of company stock held by the minority partner is worth 2/3 of a share held by the investors who own 75% of the company.

Valuing a partner’s business ownership stake for buy-out

In partner buy-outs, you can determine the value of a business ownership interest in three steps:

- First, calculate the total business enterprise value.

- Next, determine the pro-rata share based on the ownership split.

- Finally, apply the minority discount to establish the worth of the partner’s business ownership interest.

Using our earlier example, let’s say that the partner who owns 25% of the company wishes to depart. The total business value of $1,000,000 is divided into two pro-rata pots of $750,000 and $250,000. Applying the 33.33% minority discount to $250,000 gives the value of $166,675.